2020 tax exemptions and deductions – donations tax deductions

· Nonresident and Part-Year Resident Deductions and Exemptions, Nonresidents and part-year residents have to follow certain rules when it comes to personal income tax exemptions and deductions, Page updated: March 3, 2020

IRS 2020 Tax Tables Deductions & Exemptions — purposeful

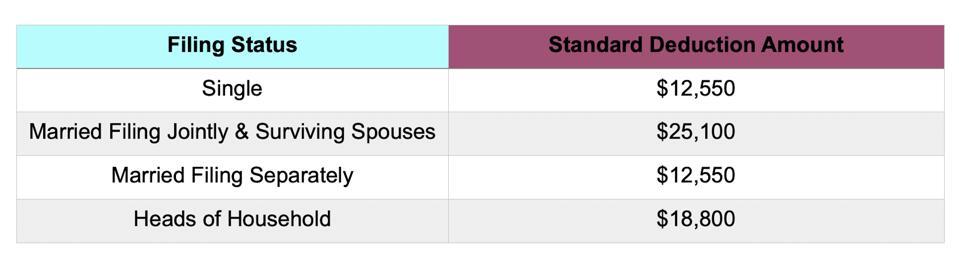

Tax Year 2020 Standard Deduction and Exemptions filed in 2021 Single – $12400; Married Filing Joint – $24,800; Married Filing Separate – $12,400; Head of Household – $18,650; Qualifying Widower – $24,800; Personal Exemptions- ELIMINATED, A person is considered …

· Income tax deductions offer a gamut of opportunities for saving tax for the salaried class With the help of these deductions and exemptions and one could reduce his/her tax substantially In this article we try to list some of the major deductions and allowances available to the salaried persons using which one can reduce their income tax liability, Exemption of Allowances House Rent

Learn about tax deductions

· December 17 2020 Tax Deductions The IRS dependent exemption is aimed at taxpayers who need to pay for dependents Most commonly, parents would apply for this because they have children,

Income Tax Allowances & Deductions Allowed to Salaried

· Energy Tax Breaks for 2020 Tax Year, They include credits for: Energy efficient homes, Energy-efficient commercial buildings, Nonbusiness energy property, Qualified fuel cell vehicles, Alternative fuel vehicle refueling property, Energy tax incentives for biodiesel and renewable diesel extended through 2022, Tax Relief in Disaster Situations

Dependent Tax Deductions and Credits: Tax Exemptions

· Tax exemptions have become an effective tool for promoting investments and savings Some of the exemptions like investments listed under Section 80C of the Income Tax Act 1961 are well-known but there are a host of other tax exemptions allowed by the government, Tax Exemption under Section 80C, It is the umbrella section for tax saving for

Publication 501 2020, Dependents

Although the exemption amount is zero for tax year 2020, this release allows the noncustodial parent to claim the child tax credit, additional child tax credit, and credit for other dependents, if applicable, for the child, The noncustodial parent must attach a copy of the form or statement to his or her tax return,

· Deductions & Exemptions In addition to the tax rates the IRS upped many of the deductions and exemptions Americans use to lower their taxable income calculation and therefore their taxes Below are some of the most common deductions and exemptions Americans can take, Standard Deduction for 2020, …

Temps de Lecture Estimé: 7 mins

2020 Standard Deduction and Exemption Amounts – Support

The Tax Cuts and Jobs Act increased the child tax credit for tax years 2018 through 2020 from the old $1000 limit The new child tax credit results in up to a $2000 credit per qualifying child age 16 or younger If you owe no tax up to $1400 of the new child tax credit may be refundable using the Additional Child Tax Credit,

Standard deductions exemption amounts and tax rates for

2020 tax exemptions and deductions

2020 IRS Standard Deductions and Exemptions

What Are Tax Deductions?

Tax Exemption 2020-2021: Understand Tax Exemption and

The tax exemption will apply to interest dividend and capital gain incomes In a notification the Central Board of Direct Taxes CBDT the scope of ‘infrastructure’ for the purpose of claiming income tax exemption under Section 10 23FE of the I-T Act introduced via the Finance Act 2020 was widened, The section permits a certain exclusive category of non-resident investors on their income streams such as dividends, interest and capital …

What is the IRS Dependent Exemption 2020 2021?

For married filing/Registered Domestic Partner RDP jointly qualifying widower or head of household taxpayers the standard deduction increases from $9074 to $9,202 for tax year 2020, The personal and senior exemption amount for single, married/RDP filing separately, and head of household taxpayers will increase from $122 to $124 for the 2020 tax year 2020,

Tax Exemption & Its Various Categories for FY 2020-21

New Tax Regime

Tax Credits and Deductions

· Let us discuss the New Tax Regime – List of exemptions and deductions disallowed in detail, During the Budget 2020, Finance Minister introduced the new tax regime, However, an option has been given to pay tax at lower rates, if you fulfill certain conditions, One such condition is you are not eligible for a few exemptions and deduction,