2020 virginia state taxes – virginia usa

2020 virginia state taxes

Individual Income Tax, Corporation and Pass Through Entity Tax, Credits, Subtractions and Deductions, Insurance Premiums License Tax, Sales & Use Tax, Withholding, Miscellaneous,

Home

Virginia Tax Rates & Rankings

Virginia State Taxes 2020

Forms

Per the Virginia Tax website: Typically, most people must file their tax return by May 1, However, the filing deadline for 2020 individual income tax returns has been extended to Monday, May 17, 2021, For more information about filing your return this year, see Avoid Pandemic Paper Delays: Tips for Filing Season ,

Virginia Income Tax Rates for 2021

Virginia State Income Taxes

40 lignes · 2020 : Virginia Estimated Income Tax Payment Vouchers and Instructions for Individuals File Online: 760ES 2021 2020 : Virginia Estimated Income Tax Payment Vouchers and Instructions for Individuals for tax year 2021 File Online: 760IP: 2020 : Virginia Automatic Extension Payment File Online: 760-PMT: 2020

135 lignes · · The state of Virginia has a progressive income tax, with rates ranging from 2% to a top rate of

The Virginia income tax has four tax brackets with a maximum marginal income tax of 5,75% as of 2021 Detailed Virginia state income tax rates and brackets are available on this page

Communications Taxes; Aircraft and Watercraft; Other Sales Taxes; Sales Tax Holiday; Employer Withholding; Corporation Income Tax; Pass-Through Entities; All Other Business Taxes, Bank Franchise Tax; Cigarette and Tobacco Taxes, Cigarette Resale Exemption …

Individuals, File Online, Make a Payment, Where’s My Refund, Look Up My 1099G, Tax Professionals

Property Tax and Real Estate Tax Questions

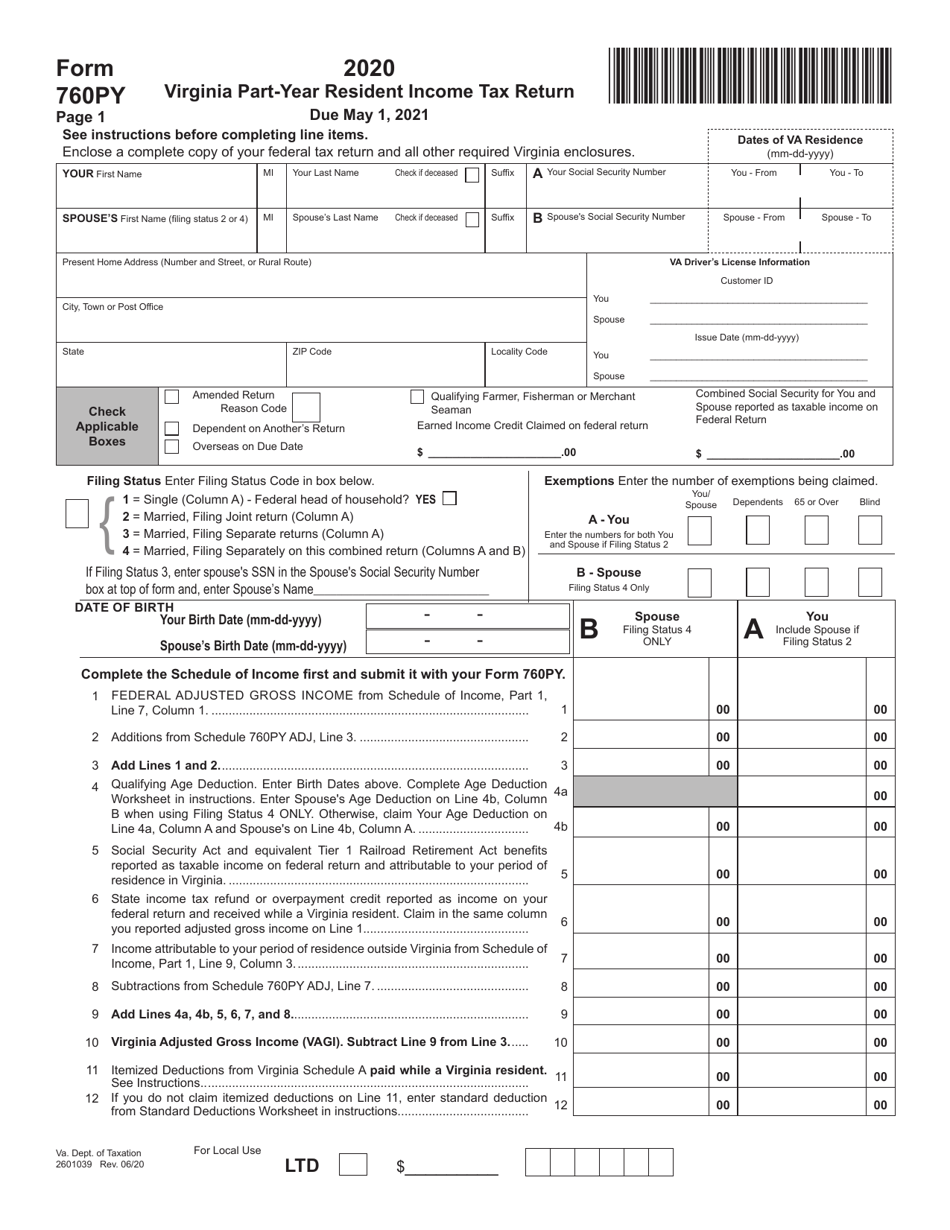

2020 Tax Year Virginia Income Tax Forms Virginia State Income Tax Forms for Tax Year 2020 Jan 1 – Dec 31 2020 can be e-Filed in conjunction with a IRS Income Tax Return Details on how to only prepare and print a Virginia 2020 Tax Return, The VA Tax Forms are below,

2020 Virginia State Salary Calculator; 2020 Virginia State Salary Comparison Calculator; 2020 Virginia State Salary Examples; 2020 Virginia State Sales Tax Rates The list below details the localities in Virginia with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator https://us,icalculator,info/terminology/us-tax-tables/2020/virginia,html; Accomack County: 5,3% sales tax

How to Calculate 2020 Virginia State Income Tax by Using State Income Tax Table, 1, Find your income exemptions, 2, Find your pretax deductions, including 401K, flexible account contributions 3, Find your gross income, 4, Check the 2020 Virginia state tax rate and the rules to calculate state income tax,

Virginia Income Tax Calculator

Virginia State Taxes 2020 Summarized by PlexPage, Last Updated: 25 October 2020 * If you want to update the article please login/register, General , Latest Info, Virginia Filing Due Date: VA individual income Tax returns are due by May 1, If you file based on the fiscal year, your return is due in 15 days of 4 months following the end of the taxable year, Extend Deadline with Virginia Tax

Learn about Virginia tax rates, rankings and more, Explore data on Virginia’s income tax, sales tax, gas tax, property tax, and business taxes,

Virginia tax tables

Individual Income Tax Filing

Forms & Instructions

Local Taxes, Personal property taxes and real estate taxes are local taxes, which means they’re administered by cities, counties, and towns in Virginia, Tax rates differ depending on where you live, If you have questions about personal property tax or real estate tax, contact your local tax office,

Virginia Income Tax Bracket and Rates and Standard Deductions

File your Virginia return for free Made $72,000 or less in 2020? Use Free File, If you made $72,000 or less in 2020, you qualify to file both your federal and state return through free, easy to use tax preparation software, Start Free File, Don’t qualify for Free File? Try Free Fillable Forms