calculate money weighted return – money weighted return calculator

To calculate the time-weighted return of an investment portfolio, we must: Identify all holding intervals Identify all withdrawals and deposits Calculate holding interval return HIR for each interval Find the geometric mean of the HIRs by adding 1 to each return and multiplying them together, then

Calculating Your Money-Weighted Rate of Return MWRR

Money-Weighted Rate of Return Calculator with Excel Sheet Excel Details: However manually calculating your investment portfolio’s money-weighted rate of return is not a trivial task,This money-weighted rate of return excel calculator is an easy-to-use tool that takes the headache out of performance tracking and keeps you up-to-date with your portfolio returns,

Money vs, Time-Weighted Return

· The money-weighted method can also be useful for calculating rates of return when cash flows are small relative to the size of the portfolio For example if you have $200000 in your RRSP and you make monthly contributions of $500 a MWRR would be an appropriate measure It would likely be very close to your TWRR However, if you have $40,000 in your TFSA, and you add a $10,000 lump sum in March, your MWRR …

How to Calculate your Money-Weighted Rate of Return MWRR

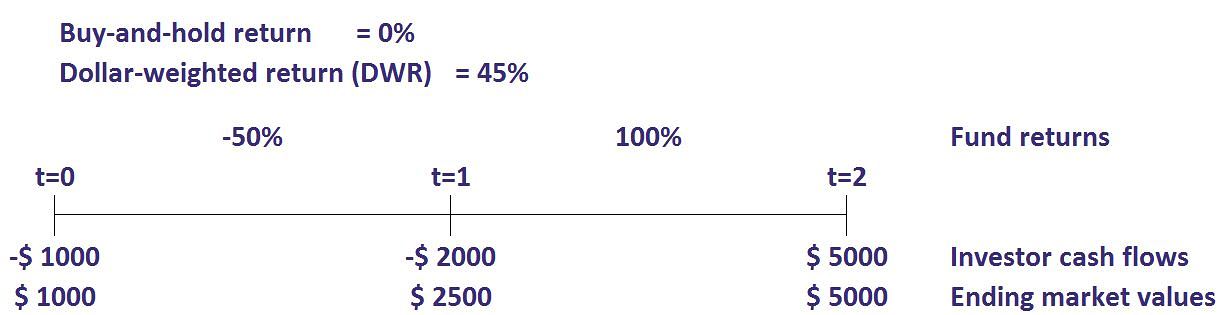

· If there were no deposits or withdrawals made during the period then the money-weighted rate of return = time-weighted rate of return Therefore two investors could invest in the same portfolio allocation and have the same TWRR but have drastically different MWRRs

Critiques : 5

Money-weighted Rate of Return

· Time weighted returns are the most common way investors will see a return communicated A time-weighted return can be thought of as the return on the initial balance of an investment over a certain period For example investing $1 in the S&P 500 for one year Common indices such as the S&P 500 are reported in time-weighted returns, Time weighted returns can refer to a price-only return, or a total return …

Money Weighted Return Calculation Excel

· The money-weighted rate of return MWRR refers to the internal rate of return on a portfolio, It is the rate of discount, r, at which: $$ \text{PV of cash outflows} = \text{PV of cash inflows}, $$ The money-weighted rate of return on a fund satisfies the equation of value by taking the initial and final fund values, as well as the intermediate cash flows, into account , When dealing with an investment portfolio, cash inflows comprise:

Money-Weighted Return Example Question

Money-Weighted Rate of Return MWRR

· The money-weighted rate of return can be thought of as the rate of return r which equates the right hand side of the following equation to the ending portfolio value V 1 Source: CFA Institute This method can be useful for calculating the rate of return when there have been only small external cash flows during the measurement period relative to the size of the portfolio

Temps de Lecture Estimé: 5 mins

Money-Weighted Rate of Return Calculator with Excel Sheet

· Learn how to calculate money-weighted and time-weighted rates of return, Click To Tweet , The TWR aims to eliminate this problem by measuring compound growth irrespective of money flows, To calculate TWR, we need to know when and how much new money is invested, when and how much of a withdrawal is made, and what the portfolio value was at the time, Returns are then calculated for each period between …

How to Interpret Investment Returns: Money-Weighted vs

The money-weighted rate of return is difficult to calculate by hand as it requires a lot of trial-and-error plugging; thankfully, there are many programs that can solve it easily, such …

Money-Weighted Rate of Return Definition

· The money-weighted rate of return can be thought of as the rate of return r which equates the right hand side of the following equation to the ending portfolio value V 1 Source: CFA Institute This method can be useful for calculating the rate of return when there have been only small external cash flows during the measurement period relative to the size of the portfolio

IRR or money-weighted returns = -8% This tells the investor about what she actually earned on the money invested for the entire three year period, Note that this return is negative because a significantly large amount of money was invested in the year of negative returns compared to other years,

Temps de Lecture Estimé: 2 mins

calculate money weighted return

How to Calculate the Money-Weighted Rate of Return To calculate the IRR using the formula set the net present value NPV equal to zero and solve for the discount rate However because of the nature of the formula the IRR cannot be calculated analytically and instead must be calculated

How to Calculate MWR and TWR

How to Calculate Money-weighted Returns

· Money-weighted return is the internal rate of return of an investment, It is the rate of return that equates the initial value of an investment with future cash flows such as dividends and sale proceeds, Over multiple periods, it inherently overweights and underweights individual period returns with …