compare offset mortgages – best mortgage interest rates today

Top 10 Offset Mortgages

Offset mortgages

· Apply for an offset mortgage with L&C, If you’re looking for an offset mortgage to help you save money, we’re here to give you a hand, At L&C, we’re experts in offset mortgages and can find the best deal on the market for you, See which deals you’re eligible for by using our online Mortgage Finder – it’ll compare …

compare offset mortgages

· Offset mortgages can reduce the mortgage interest you pay and cut your mortgage term by years, Find out if an offset mortgage is right for you with Uswitch,

Compare Offset Mortgage Deals & Apply Online

Compare Offset mortgages

Offset mortgage comparison Advantages of offset mortgages, With an offset mortgage you retain access to your savings, so it’s a more flexible option than using your savings to pay off a portion of your mortgage, It also means you don’t lose any of your savings – you can withdraw them from the account at …

Compare Offset Mortgage Rates and Deals, Use our offset mortgage comparison tool to compare all kinds of rates and deals, Property Price £ Mortgage Amount £ Mortgage Term 1-30 years Mortgage Type, Product Rate, Initial Rate Period, Loan Type, Advanced filters, Cashback, Exclusive, No booking or arrangement fee, No early repayment charge, Overpayments allowed, Offset, Limited company buy to

Offset mortgages can be tax-efficient if you’re a higher- or additional-rate taxpayer, Offset mortgages will often allow you to make overpayments, though early repayment charges may apply, Cons, Interest rates on offset mortgages can be higher than comparable standard repayment mortgages,

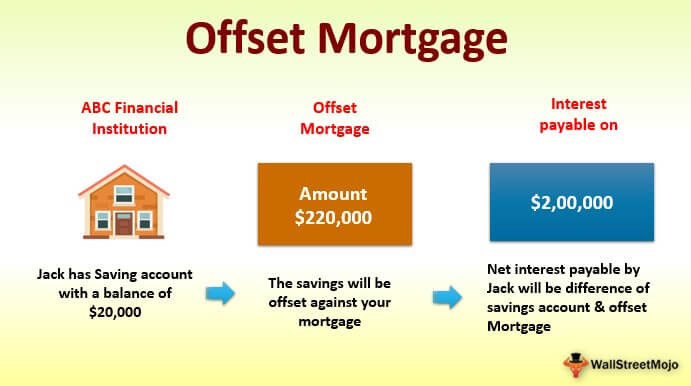

Offset mortgages can lower your monthly payments or reduce your mortgage term, Here’s an example – if you have a mortgage balance of £100,000 and offset £20,000 in savings, you will only be charged interest on £80,000, That saving can be used to lower your monthly payments or shorten your mortgage term,

Compare Offset Mortgages

· Offset mortgages can be a great way to manage your money, but they can be complex, The simplest way to see if an offset mortgage is right for you is to compare a …

Temps de Lecture Estimé: 8 mins

Best Offset Mortgage Rates UK: Compare Deals

Offset mortgages

· Compare Offset mortgage which can offset the mortgage balance with the funds in the savings account of the same financial institution as the mortgage,

Compare Offset Mortgages

Offset mortgage accounts

7 lignes · Compare offset mortgages; Offset mortgages; The mortgage will be secured on your home, Your home may be repossessed if you do not keep up repayments on your mortgage, Our range of Offset mortgages allow you to reduce the amount of interest you pay by offsetting your savings against your mortgage, However, no interest is paid on your savings all the time they are connected to your mortgage, You

Compare Offset Mortgages

Compare mortgages with MoneySuperMarket, While MoneySuperMarket does not currently offer offset mortgages, you can compare other types of mortgage with us, All you need to do is enter some details about how much you need to borrow and over what period of time, the value of your property, and whether you’ll repay interest only or both interest

Offset mortgages allow you to use your savings to reduce the amount of interest you pay on your outstanding mortgage balance, Compare every offset mortgage and find the best offset mortgage …

Offset Mortgage

Compare Offset Mortgages – Why Every Option Is Different, EverythingFinance Offset Mortgage, Personal Finance, If you own a home and have some savings, then an offset mortgage could make your savings work for you – and save you money into the bargain, An offset mortgage is one of a new kind of mortgage that offers flexibility to homeowners, Offset mortgages work by allowing you to offset

Compare The Best Offset Mortgage Deals

Offset mortgage rates vary with your LTV and credit score just the same as any other mortgage, How to compare offset mortgages, Like any mortgage, you still want to compare offset mortgages on

Offset mortgages