consistency principle gaap – 10 gaap principles of accounting

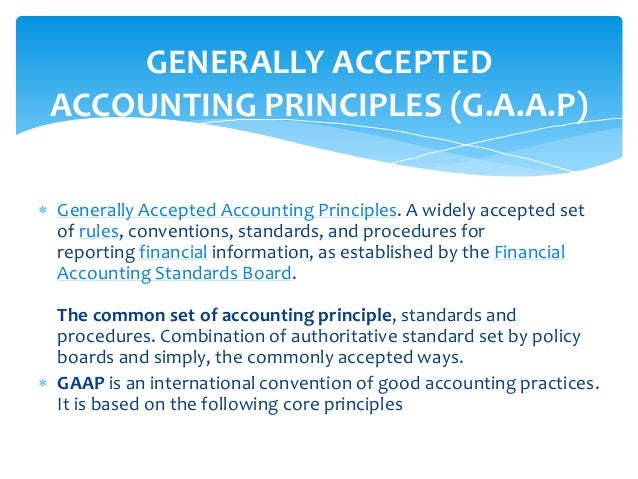

GAAP: Generally Accepted Accounting Principles

Consistency Principle of Accounting

Consistency of Application of GAAP 2117 08 A change in the reporting entity resulting from a transaction or event such as a pooling of interests or the creation, cessation, or complete or partial

Consistency principle definition — AccountingTools

The GAAP consistency principle makes it easy for: Outside auditors to review your books Angel investors and VC firms to assess your finances when they’re deciding whether or not to fund your company You and other key decision makers in your company to review your financial statements to make smart

The consistency principle of accounting states that a company should use the same accounting policies and methods for recording similar events or transactions from one financial period to another, It is necessary that a company consistently apply its accounting methods and policies from one financial year to another,

Consistency Principle Definition Example How it Works?

consistency principle gaap

· In some cases, a lender or investor will request that the client’s financial statements are audited to look for internal controls and determine if the financial statements are represented fairly and compiled in accordance with generally accepted accounting principles GAAP, One of the things auditors look for is the Consistency Principle, To help you learn more about this concept and adopt it in your accounting practices, …

· What is the Consistency Principle? The consistency principle states that once you adopt an accounting principle or method continue to follow it consistently in future accounting periods Only change an accounting principle or method if the new version in some way improves reported financial r

Which statement describes the GAAP consistency principle

The GAAP Consistency Principle: How It Affects Your Business

Consistency principle

The consistency principle is one of the guidelines and standards which businesses are required to follow according to the accounting principles listed under UK GAAP, Why do we use the consistency principle? The sole purpose of the consistency principle, or consistency concept, is to ensure that transactions or events are recorded in the same way, from one accounting year to the next,

Consistency Principle GAAP Example

The GAAP consistency principle states that when a business has fixed a method for the accounting treatment of an item it will enter all similar items in the exact same way in the future Which method is required by GAAP? accrual accounting method What are generally accepted accounting principles quizlet? Generally Accepted Accounting Principles are principles, rules, and standards to be

What are the 4 principles of GAAP PDF? The four basic constraints in generally accepted accounting principles are: objectivity materiality consistency and prudence The objective constraint states that all the information included in the financial statements must be supported by independent, verifiable evidence,

Consistency of Application of Generally Accepted

· Fichier PDF

What is the Consistency Principle? Consistency Principle states that all accounting treatments should be followed consistently throughout the current and future period unless required by law to change or the change gives a better presentation in accounts This principle prevents manipulation in accounts and makes financial statements comparable across historical periods, Explanation

Consistency of Application of GAAP 2125 standard relates: “When the independent auditor reports on two or more years he should address the consistency of the application of accounting principles between such years , ,” For a FIFO to LIFO change made in the earliest year presented and reported on, there is no inconsistency in the application of

What Is the Consistency Principle?

· Consistency Principle is one of the Accounting Concepts and it is included in Generally Accepted Accounting Principles GAAP

Consistency of Application of Generally Accepted

· Fichier PDF

These 10 general concepts can help you remember the main mission of GAAP: 1 Principle of Regularity The accountant has adhered to GAAP rules and regulations as a standard 2 Principle of Consistency Accountants commit to applying the same standards throughout the reporting process, from one 3,

What are the 4 principles of GAAP PDF?

GAAP is set forth in 10 primary principles, as follows: Principle of consistency: This principle ensures that consistent standards are followed in financial reporting from Principle of permanent methods: Closely related to the previous principle is that of consistent procedures and practices