formula irr – irr formula excel

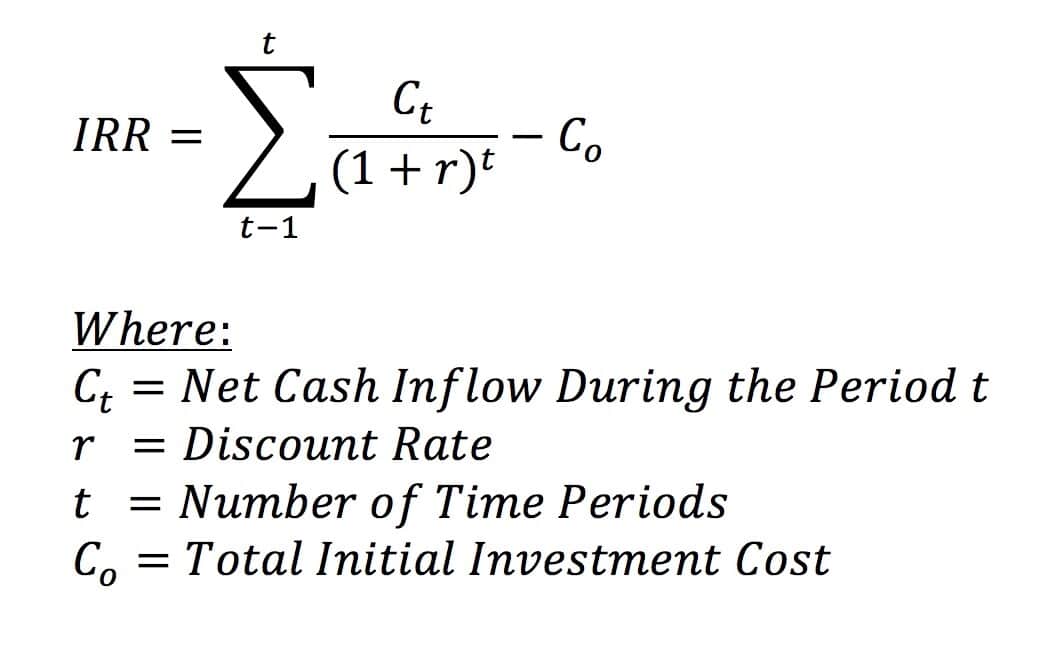

· Internal Rate of Return Formula, The IRR formula is as follows: 0 NPV = P0 + P1/1+IRR + P2/1+IRR2 + P3/1+IRR3 + , , , +Pn/1+IRRn, Where: P0 equals the initial investment cash outflow P1, P2, P3, equals the cash flows in periods 1, 2, 3, etc, IRR equals the project’s internal rate of return, NPV equals the Net Present Value

Internal Rate of Return IRR

Formula, Description, Result =IRRA2:A6 Investment’s internal rate of return after four years-2,1% =IRRA2:A7 Internal rate of return after five years, 8,7% =IRRA2:A4,-10% To calculate the internal rate of return after two years, you need to include a guess in this example, -10%,-44,4%

Example: try that again but use an interest rate of 6% The interest rate r is now 6% which is 0,06 as a decimal: PV = FV / 1+r n PV = $900 / 1 + 0,06 3 PV = $900 / 1063, PV = $755,66 to nearest cent When we only get 6% interest, then $755,66 now is as valuable as $900 in 3 years,

Taux de rentabilité interne — Wikipédia

formula irr

· Calculating IRR, The NPV is calculated by taking the total summation of the cash flow and then multiplying that by the dividend of net cash outflows divided by one plus the discount rate of return, It is a complex calculation usually done using computer software or advanced calculators,

Internal Rate of Return IRR Definition & Formula

Pour déterminer le TRIM on calcule la valeur capitalisée de toutes les rentrées de fonds Ensuite on actualise toutes les sorties de fonds au taux de rendement requis Le TRIM est le taux d’actualisation pour lequel la valeur actuelle des sorties de fonds est égale à la valeur actuelle de la valeur finale du projet

Manquant :

formula

How to Calculate IRR Using the formula one would set NPV equal to zero and solve for the discount rate which is the IRR The initial investment is always negative because it represents an outflow, Each subsequent cash flow could be positive or negative, depending on the estimates of what the

IRR function

Internal Rate of Return Formula

So the formula for IRR is same as the formula for NPV The formula can be written as below : Where in the above formula : N = total number of periods n = positive integer C = cash flow negative or positive value r = internal rate of return or discounted rate NPV = net present value,

Explorez davantage

| Internal Rate of Return IRR Calculator | www,calculatestuff,com |

| Internal Rate of Return IRR Formula Example , Calculator | www,myaccountingcourse,com |

| Internal Rate of Return IRR Definition & Formula | www,investopedia,com |

| Formula for Calculating Internal Rate of Return IRR in Excel | www,investopedia,com |

| IRR Calculator – Calculate Internal Rate of Return | www,gigacalculator,com |

Recommandé pour vous en fonction de ce qui est populaire • Avis

Excel was used to calculate the IRR of 13%, using the function, =IRR, From a financial standpoint, the company should make the purchase because the IRR is both greater than the hurdle rate and the IRR for the alternative investment, What is the Internal Rate of Return Used For?

Formula for Calculating Internal Rate of Return IRR in Excel

IRR Function

Put simply, the IRR is determined by experimenting to find the rate which cause the NPV of a series of payments to equal $0, The above formula is a derived version of the NPV formula: $$NPV = \displaystyle\sum_{t=1}^{T} \dfrac{Ct}{1+r^{t}}$$ If the payments for each cash flow are expected to be the same, you can also use the simpler NPV formula:

Internal Rate of Return IRR

IRR Formula : Formula for calculating internal rate of return

Internal Rate of Return

Internal rate of return

How To Calculate IRR

The sum of all these discounted cash flows is then offset by the initial investment which equals the current NPV To find the IRR you would need to “reverse engineer” what r is required so that

Internal Rate of Return IRR

Both the secant method and the improved formula rely on initial guesses for IRR, The following initial guesses may be used: The following initial guesses may be used: r 1 = A / , C 0 , 2 / N + 1 − 1 {\displaystyle r_{1}=\leftA/,C_{0},\right^{2/N+1}-1\,}

· The “IRR” function, or, The “RATE” function, The Excel IRR function takes a bit more work in that you need to layout the stream of cash outflow and cash inflow first, and only then apply the formula, Like this…, Notice that we’ve laid out -5,000 in one cell, and then 5,800 right beside it,

XIRR assigns specific dates to each individual cash flow making it more accurate than IRR when building a financial model in Excel,, IRR Formula =IRRvalues,[guess]