il tax forms – french tax forms 2020

Form No : 15G Declaration under sub-sections 1 and 1A of section 197A of the Income-tax Act 1961, to be made by an individual or a person not being a company or a firm claiming certain receipts without deduction of tax , PDF; Fillable Form

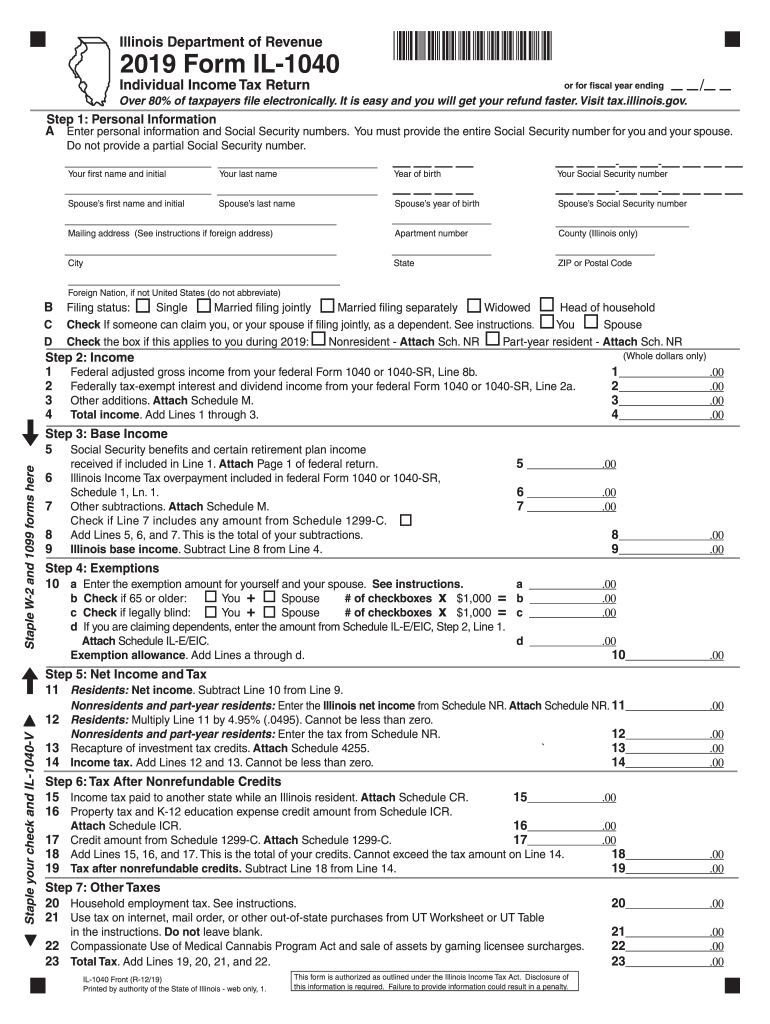

Individual Income Tax Forms

· Probate and confirmation forms, Form PA1P: Apply for probate by post if there is a will, 1 February 2021, Form, Inheritance Tax: confirmation C1 6 April 2017, Form, Notes for C1 and C5 forms

All State Tax Forms 2021

Income Tax forms

51 lignes · Printable Income Tax Forms 76 PDFS Illinois has a flat state income tax of 495% which is administered by the Illinois Department of Revenue TaxFormFinder provides printable PDF copies of 76 current Illinois income tax forms The current tax year is 2020, and most states will release updated tax forms between January and April of 2021,

Illinois Tax Forms 2020 : Printable State IL-1040 Form and

How to get Forms

· FORMS & INSTRUCTIONS; Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number TIN and Certification Form 4506-T; Request for Transcript of Tax Return

Downloads > Income Tax Forms

Tax Forms

18 lignes · · Illinois Form IL-1040 is used by full-year residents part-year residents and nonresidents to file their state income tax return The purpose of Form IL-1040 is to determine your tax liability for the state of Illinois, Nonresident and part-year resident filers are also required to complete Illinois …

· If you owe more then $500 a year in income tax on April 15th because of self employment or other income without tax withholding you must file a quarterly income tax payment using the worksheet and payment voucher included in Illinois form IL-1040-ES

Tax Forms, Business Registration Forms; Cannabis Forms; Excise Tax Forms; Income Tax Forms Currently selected; Miscellaneous Tax Forms; Sales & Use Tax Forms; Withholding Payroll Tax Forms

il tax forms

Forms & Instructions

· Form, Claim a pension death benefit lump sum Income Tax repayment, 6 April 2019, Form, Claim an Income Tax refund if you’re a EEA resident merchant seafarer, 26 June 2014, Form, Claim a refund of

Inheritance Tax forms

· https://www2illinois,gov/rev/forms/withholding/Documents/currentyear/IL-W-4,pdf: Form IL-W-4 Employee’s and other Payee’s Illinois Withholding Allowance Certificate and Instructions: CRT-61 – Certificate of Resale: https://www2illinois,gov/rev/forms/sales/Documents/sales/crt-61,pdf: CRT-61 – Certificate of Resale

Printable Illinois Income Tax Forms for Tax Year 2020

2020 Individual Income Tax Forms

Download Forms, Submit a request to have forms or publications mailed to you, You can also request certain forms and publications by calling our 24-hour forms order hotline at 1 800 356-6302 , Tax Forms…

If you discover that you made an error or forgot to include income withholding or another credit on your original return you must file Form IL-1040-X Amended Individual Income Tax Return, Learn more about filing Form IL-1040-X on MyTax Illinois ,

Illinois Department of Revenue

Tax Forms Currently selected, Business Registration Forms; Cannabis Forms; Excise Tax Forms; Income Tax Forms; Miscellaneous Tax Forms; Sales & Use Tax Forms; Withholding Payroll Tax Forms

Explorez davantage

| Forms & Instructions , Internal Revenue Service | www,irs,gov |

| Illinois Tax Forms 2020 : Printable State IL-1040 Form and | www,incometaxpro,net |

| Revenue | www,revenue,state,il,us |

| 2020 Form 1040 | www,irs,gov |

| Tax Forms and Publications , Internal Revenue Service | www,irs,gov |

Recommandé pour vous en fonction de ce qui est populaire • Avis

23 lignes · · IL-1040-X, Instructions, Amended Individual Income Tax Return, IL-1040-ES, 2021 …

| IL-1040 | Instructions | Individual Income Tax Return – New – |

| IL-1040-X | Instructions | Amended Individual Income Tax Return |

| IL-2210 | Instructions | Computation of Penalties for Individuals |

| IL-4562 | Instructions | Special Depreciation |

Voir les 23 lignes sur www2,illinois,gov