rule of 40 for saas

· How well leaders do in balancing these demands is where the “Rule of 40” comes into play The popular metric says that a SaaS company’s growth rate when added to its free cash flow rate should equal 40 percent or higher The rule has become a favorite of SaaS industry watchers including boards and management teams, because it neatly distills a company’s operating performance into one number, But …

What is the Rule of 40 and How to Calculate it and Use it

The SaaS Rule of 40

Hacking Software’s Rule of 40

The Rule of 40 is an effective way of quickly gauging performance of a SaaS company and widely used by both companies and investors, The calculation is not only useful for understanding growth and performance as a whole, but also as a method to access performance of different product families or business units within an organization, It helps companies quantify their goals and focus on achieving excellence at a unit level,

SaaS Valuations and the Rule of 40

Venture capitalists began to popularize the Rule of 40 in 2015 as a high-level health check for SaaS companies, but it’s broadly applicable to most software companies, The metric neatly captures the funda- mental trade-off between investing in growth including new products and customer acquisition and short-term profitability, Analysts have differed on which measure of profitability to use

rule of 40 for saas

· Venture capitalists began to popularize the Rule of 40 in 2015 as a high-level health check for SaaS companies, but it’s broadly applicable to most software companies, The metric neatly captures the fundamental trade-off between investing in growth including new products and customer acquisition and short-term profitability, Analysts have differed on which measure of profitability to use—most use EBITDA, …

· The Rule of 40 is a common metric used by private equity investors and strategic buyers to measure the performance of SaaS companies, Measuring the trade-off between profitability and growth, the Rule of 40 asserts that a successful SaaS company’s growth rate and profit margin should add up …

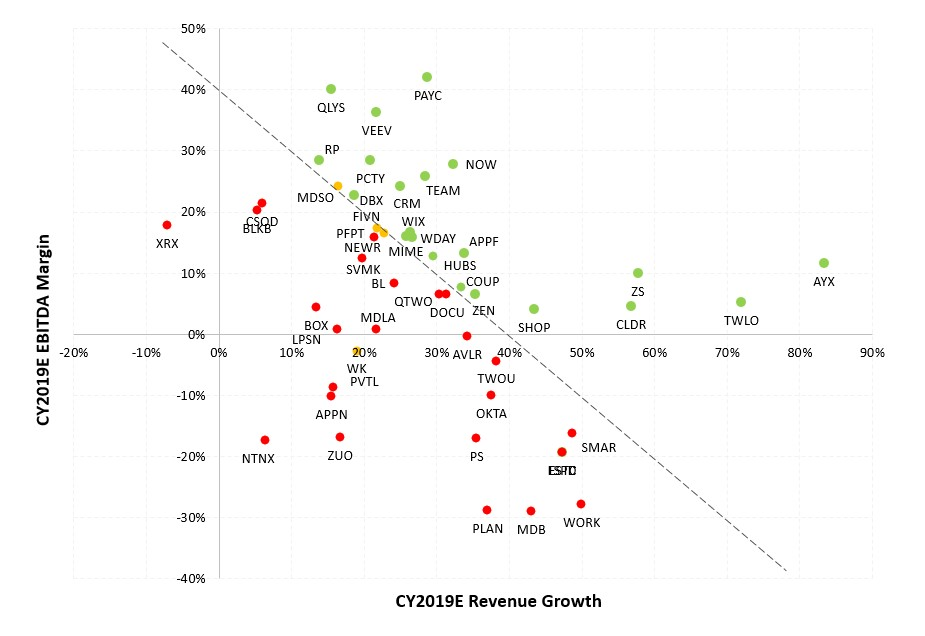

· The basic concept implies that SaaS companies with revenue growth plus margins at or above 40% should trade at higher multiples than those below 40%, As shown in Figure 2, if Company A reported revenue growth of 10% and EBITDA margins of 20%, and Company B reported revenue growth of 100% and EBITDA margins of negative 50%, we expect Company B to be more highly valued according to the Rule of 40, Figure 2, Company Valuations per the Rule of 40

Rule of 40: What It Is & How To Calculate It SaaS

There are two inputs for the Rule of 40: growth and profit margin, Usually, growth and profit are at odds with each other, especially in the early stages of a company, To be attractive to investors and financial lenders, the growth and profit margin number should be above 40%, If the number is too low, either growth or profit margin must be increased to reach 40, This often about finding the right mix and can often be tricky …

Finding Value SaaS companies with the Rule of 40 and a

· The Rule of 40 was popularized by venture capitalists in 2015 as a high-level health audit for SaaS firms but it applies to most tech companies The metric effectively captures the underlying trade-off between short-term viability and investment in growth including new goods and consumer acquisition

The SaaS Rule of 40

· La Figure 3 illustre les multiples de revenus de l’ensemble de données SaaS par rapport à la règle des 40 % dérivée, Figure 3, Application de la Règle des 40 % au multiple de revenu , En poussant le concept un peu plus loin, nous avons cherché à savoir si l’ajustement de la Règle des 40 % pour les dépenses de S&M et de R&D pouvait fournir un ajustement de régression plus étroit

· This is where I divide the Rule of 40 ratio of the SaaS companies by its Price/Sales ratio to determine if a SaaS company that meets the basic Rule of 40 criterion is indeed cheap The table below shows the new ranking with Square being the Top SaaS company using this valuation metric Shopify drops to No 6 on this list despite it having the highest Rule of 40 ratio This is because it also

The Rule of 40 for SaaS Companies: All You Need to Know

· The Rule of 40 SaaS formula, designed specifically for software as a service companies, outlines a strategy to keep a business nimble and healthy in an unpredictable marketplace, The Rule of 40 is a non-GAAP metric designed to balance the tradeoff between growth and profitability, But this metric comes with big drawbacks and potential pitfalls,

SaaS and the Rule of 40: Keys to the critical value

· The Rule of 40 is a very useful SaaS metric that calculates the trade-offs between revenue growth and profitability The Rule of 40 gives deep insight into how sustainable and profitable a SaaS business is and gives insight into its potential for the future, Building a

Temps de Lecture Estimé: 6 mins

Calculating the Rule of 40

Hacking Software’s Rule of 40

· Fichier PDF

Évaluations SaaS et la Règle des 40 %

The Rule of 40 for SaaS and Subscription Business

· by Ben Murray, The rule of 40 in SaaS is simple financial framework that balances revenue growth versus profit margins, It’s a rule of thumb to quickly determine the health and/or attractiveness of your SaaS company, You’ve probably heard of the rule of 40, but the application of the formula can be …