suspended passive losses – suspended passive losses at death

Disposing of passive activities

· When passive activities are transferred in divorce, the suspended losses of the transferor spouse are added to the basis of the asset passing to the receiving spouse, An ex-wife who was either unaware of this treatment, or thought she was being creative, treated her half of the passive losses transferred to her ex-husband as a final disposition which would have allowed her to recognize all the suspended passive losses …

If these passive losses exceed your passive income they are suspended and carried forward indefinitely until future years when you either have passive income or sell a property at a gain This is good news because a net loss for tax purposes means you aren’t paying taxes on your …

· A taxpayer can apply suspended losses against passive activity income from any source, not just from the activity that created the loss, Disposing of a passive activity allows suspended passive losses to be deducted, When a taxpayer disposes of the entire interest in a passive activity, that activity is no longer subject to the passive activity rules,

The Taxing Side of Divorce: Addressing the Issues During

In effect any loss in excess of passive income is called a suspended loss For example if a taxpayer has a passive loss of $8,000 and a passive income of $3,500, his suspended loss is $4,500,

Disposing of an Activity to Release Suspended Passive Losses

Splitting passive losses during divorce

What Happens to Suspended Passive Losses When You Sell

Details

Suspended Losses of Former Passive Activities – TaxCPE

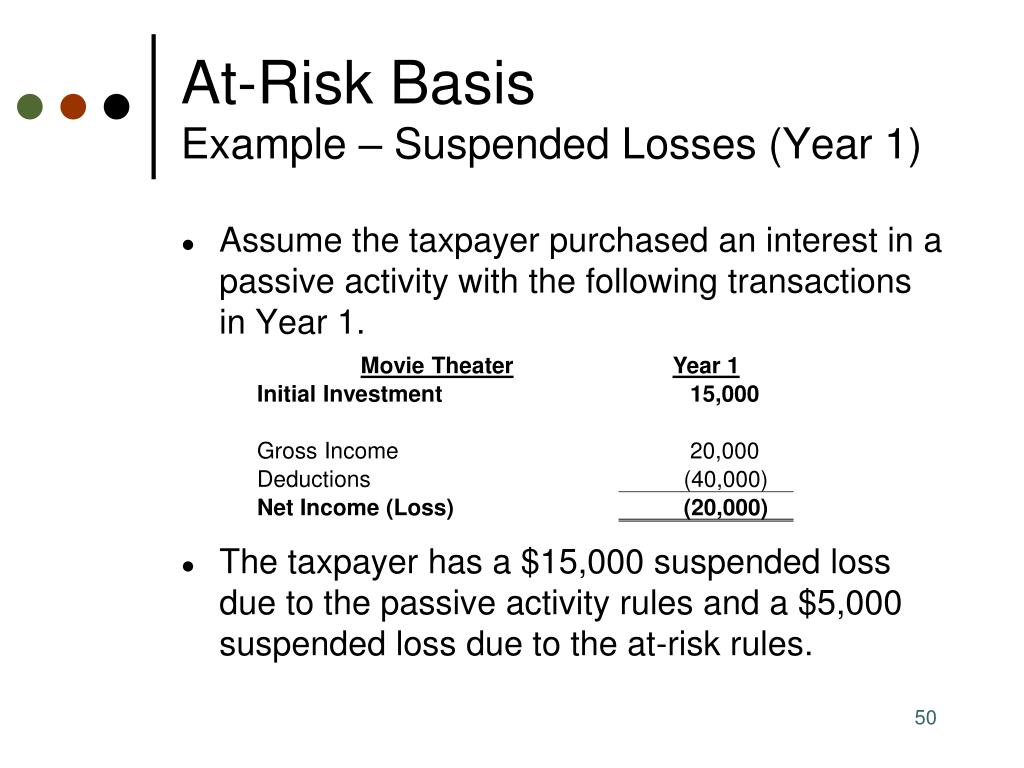

· Suspended Passive Activity Losses Losses may be suspended even if the owner has sufficient basis and a sufficient at-risk amount if the investment is also classified as a passive activity since passive losses can only be deducted from passive income Suspended passive losses can be carried forward to future tax years to be deducted from future passive income earned from whatever source, However, if the owner …

American Institute of Certified Public Accountants

· Fichier PDF

· What Are Suspended Passive Losses? Though there are limits on how much of your passive losses you can write off and these deductions only apply to your passive income there is one passive loss rule you must remember You can suspend excess passive losses into future tax years

There’s rarely any black or white when it comes to taxation especially real estate taxation A suspended passive loss will occur when the investor’s income actually it’s called Modified Adjusted Gross Income but we’ll keep it simple and just say “income” is too high,

Suspended Loss Definition

· – Suspended losses become non-passive on disposition of the activity Taxpayers Subject to Section 469 Individuals Estates and Trusts Closely-held C corporations – Passive losses may offset active income but not portfolio income Personal Service Corporations Not partnerships or S corporations but partners and shareholders may be subject on their distributive share, Categories of

Understanding Passive Activity Limits and Passive Losses

However any loss remaining is carried forward as a suspended passive loss 3 If the result of item 1 is a loss this loss can be offset against any net income or gain from all other passive activities net of suspended losses carried from earlier years If any of the loss from the disposed activity remains it can then be deducted as a nonpassive loss,

Suspended Losses from the Disposition of an Interest in a

Suspended Passive Activity Loss Carryovers Losses from passive activities are generally deductible only to the extent of gains from other passive activities If passive activities produce a net loss the loss is suspended indefinitely and may be deducted from passive activity income in succeeding tax years,

Tactics to Utilize Suspended Passive Losses — Illumination

Suspended Passive Losses – Former Principal Residence – In a taxpayer-friendly result in Chief Counsel Advice CCA201428008 IRS has determined that suspended passive activity losses from the passive rental of a home which was formerly used as the taxpayer’s principal residence did not offset gain excluded under Code Sec 121 on the property’s sale This leaves suspended losses available to offset taxable passive income in the future If IRS had reached a contrary result the suspended

Temps de Lecture Estimé: 2 mins

Strategies to Use Suspended Passive Losses from Rental

Suspended Losses

· Sell your property, Selling a rental asset for gain can help activate suspended passive losses from your other properties, For example, if you sell your duplex for a gain, you could activate the suspended loss created by expenses from your office building, Better yet, combine the use of your suspended losses with a 1031 exchange, The use of your suspended losses reduces your capital gains tax liability and a 1031 …

suspended passive losses