tax form 1040 schedule c – schedule c tax form printable

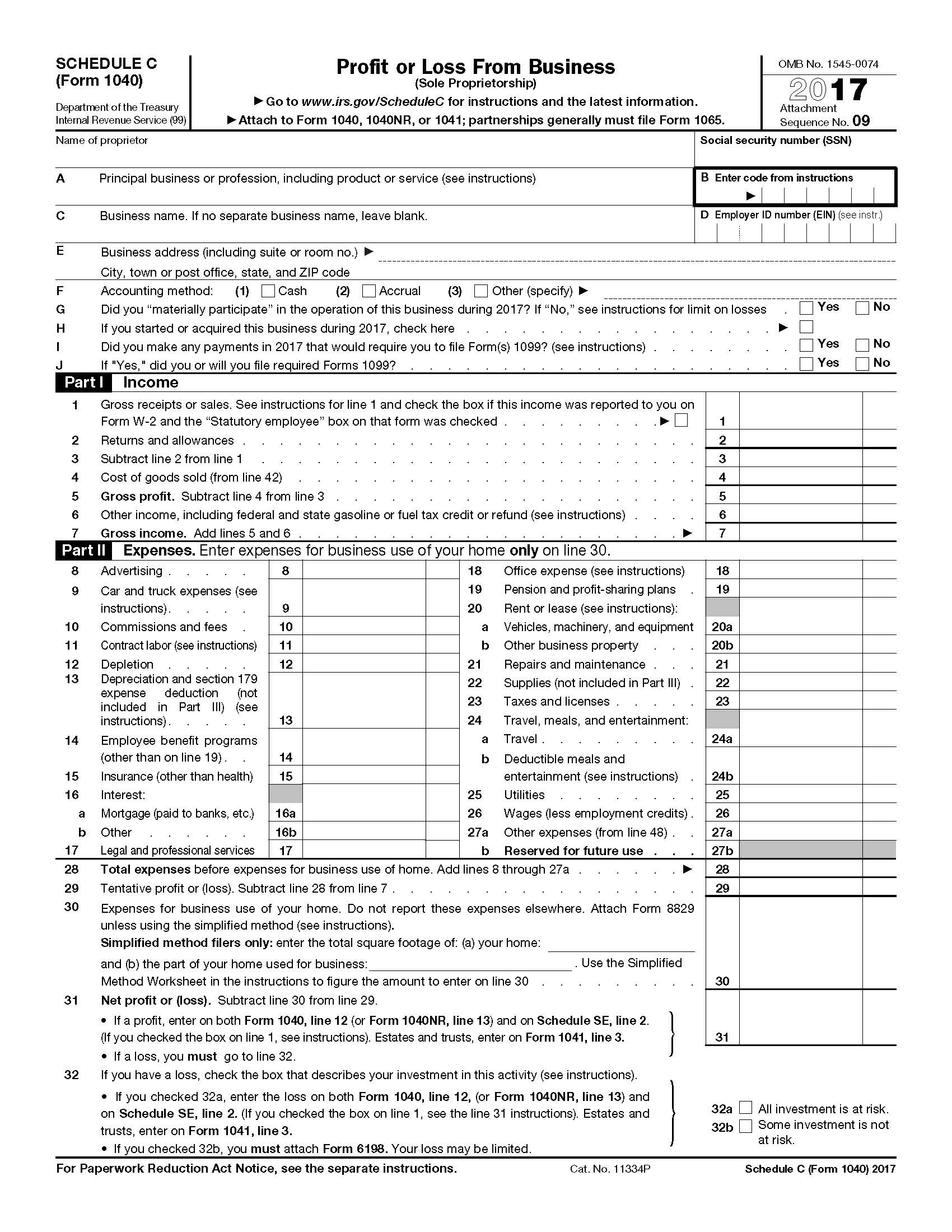

A Schedule C Form is a supplemental form that is sent with a 1040 when someone is a sole proprietor, Known as a Profit or Loss From Business form, it is used to provide information about both the profit and the loss sustained in business by the sole proprietor, This form includes information about income for the business and its various expenses, It helps you calculate the federal tax you owe

Form 1040 Schedule C

· Form 1040 Schedule C – Form 1040 form is an IRS tax form utilized for person federal income tax filings by US residents, The form analyzes the income of the tax filer and calculates just how much to be paid as tax or refund, It requires the filer to fill the form with accurate info, Right here really are a couple of small print that needs to be considered whilst filling this form, There are

2017 Schedule C Form 1040

· Fichier PDF

· Credit Karma Tax Schedule C Form 1040 – The IRS Form 1040 form will be the regular one that many individuals use to submit their tax returns to the government, This form describes your income and your tax return status, and it’s used from the IRS to collect your tax info,

Form 1040 Individual Schedule C

Clarification on how to complete the Schedule C columns 1c and 5c Form 1118 in the case of a controlled foreign corporation with 1 or more qualified business units with passive category income, The examples below replace the example found on pages 14 and 15 of the December 2020 revision of the Instructions for Form 1118, Complete columns 1c and 5c only if a controlled foreign corporation

Schedule 1 Form 1040 or 1040-SR, line 3 or , Form 1040-NR, line 13 and on , Schedule SE, line 2, If you checked the box on line 1, see the line 31 instructions, Estates and trusts, enter on , Form 1041, line 3, • If you checked 32b, you , must , attach , Form 6198, Your loss may be limited, } …

tax form 1040 schedule c

Schedule C Form 1040

Form 1040 Schedule C 2020

2020 Form IRS 1040 – Schedule C Fill Online, Printable Education Details: Easily complete a printable IRS 1040 – Schedule C Form 2020 online, Get ready for this year’s Tax Season quickly and safely with pdfFiller!Create a blank & editable 1040 – Schedule C form, fill it out and send it instantly to the IRS,Download & print with other fillable US tax forms in PDF,

Step by Step Instructions to Complete Schedule C

Information about Schedule C Form 1040 Profit or Loss from Business Sole Proprietorship including recent updates related forms and instructions on how to file Schedule C Form 1040 is used to report income or loss from a business operated or a profession practiced as a sole proprietor,

Schedule 1 Form 1040, line 12 or , Form 1040NR, line 13 and on , Schedule SE, line 2, If you checked the box on line 1, see instructions, Estates and trusts, enter on , Form 1041, line 3, • If a loss, you , must , go to line 32,} 31, 32 , If you have a loss, check the box that describes your investment in this activity see instructions,

· The IRS Schedule C form is the most common business income tax form for small business owners The form is used as part of your personal tax return For 2019 and beyond you may file your income taxes on Form 1040 The 1040-SR is available for seniors over 65 with large print and a standard deduction chart Form 1040-EZ and Form 1040-A are no longer available

Clarification Concerning Completion of Tax Year 2020 Form

SCHEDULE C Profit or Loss From Business 2019

· Fichier PDF

Credit Karma Tax Schedule C Form 1040

Form 1040, line 12 or , Form 1040NR, line 13 and on , Schedule SE, line 2, If you checked the box on line 1, see instructions, Estates and trusts, enter on , Form 1041, line 3, • If a loss, you , must , go to line 32,} 31, 32 , If you have a loss, check the box that describes your investment in this activity see instructions,

Schedule 1 Form 1040, line 3, and on , Schedule SE, line 2, If you checked the box on line 1, see instructions, Estates and trusts, enter on , Form 1041, line 3, • If a loss, you , must , go to line 32,} 31, 32 , If you have a loss, check the box that describes your investment in this activity, See instructions, • If you checked 32a

Explorez davantage

| 2020 Instructions for Schedule C 2020 , Internal Revenue | www,irs,gov |

| About Schedule C Form 1040, Profit or Loss from Business | www,irs,gov |

| 2020 Schedule C Form and Instructions Form 1040 | www,incometaxpro,net |

| 2020 Schedule 1 Form and Instructions Form 1040 | www,incometaxpro,net |

| Forms and Publications PDF | apps,irs,gov |

Recommandé pour vous en fonction de ce qui est populaire • Avis

About Schedule C Form 1040 Profit or Loss from Business

· Form 1040 Individual Schedule C – Form 1040 form is definitely an IRS tax form used for individual federal income tax filings by US citizens, The form analyzes the income from the tax filer and calculates just how much to be paid as tax or refund, It demands the filer to fill the form with accurate information, Here are a couple of small print that should be regarded as while filling this form,

· Schedule C is part of Form 1040, It’s used by sole proprietors to let the IRS know how much their business made or lost in the last year, The IRS uses the information in Schedule C to calculate how much taxable profit you made—and assess any taxes or refunds owing, You can find the fillable form here: IRS Schedule C: Profit or Loss From

2018 Schedule C Form 1040

· Fichier PDF

SCHEDULE C Profit or Loss From Business 20

· Fichier PDF

How To File Schedule C Form 1040