tax france – french tax return in english

Tax liability in France

If you are leaving FranceIf you leave France, any French earnings that are taxable in France under international tax treaties that you earned after your departure are liable for tax, and you must declare these earnings, Owing to postal delivery times, you are advised t…

Taxes in France: a complete guide for expats

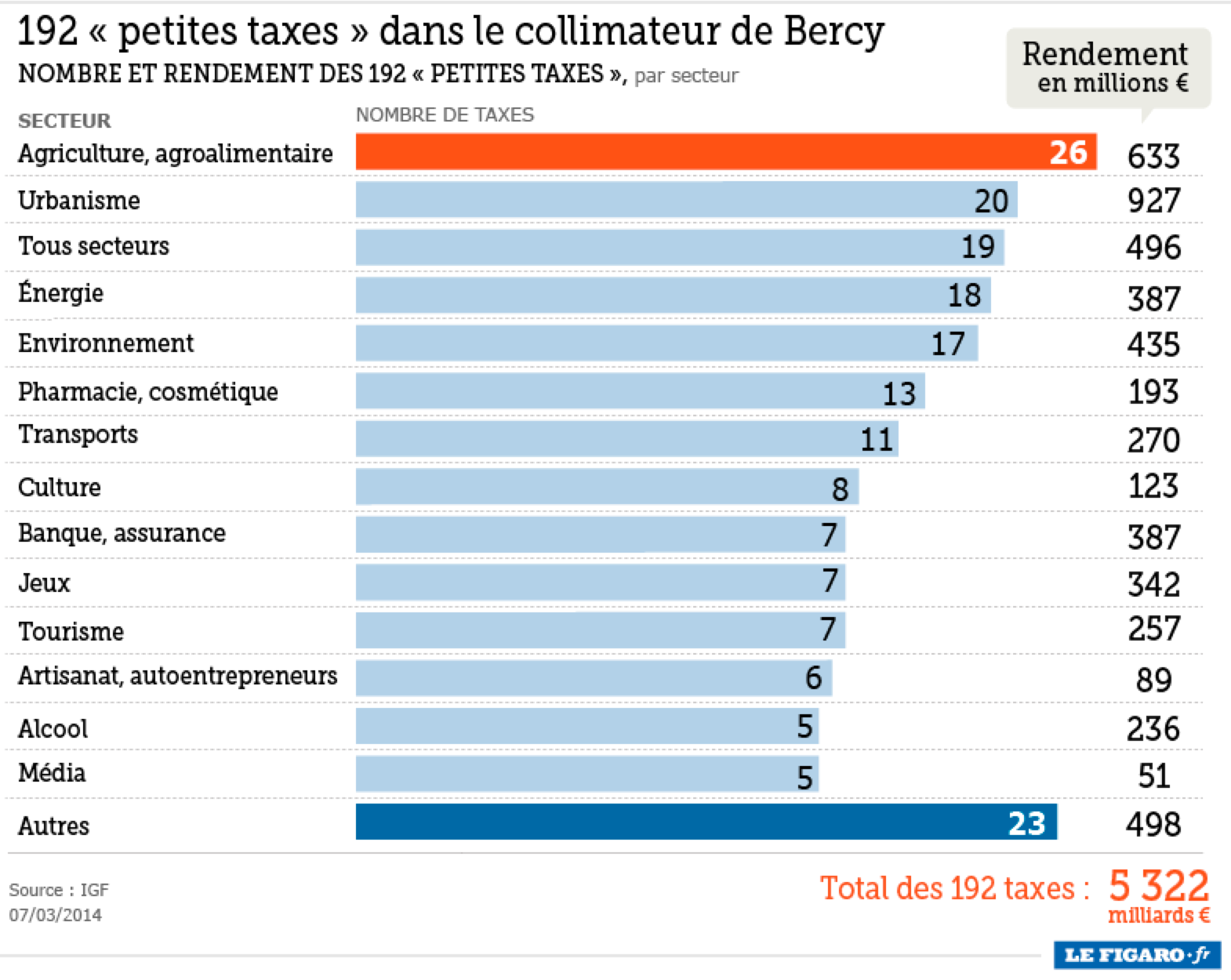

294 lignes · En 2015 selon la fondation libérale IFRAP la France compte 360 taxes et impôts ; pour la même année le président de la commission des Finances à l’Assemblée nationale Gilles Carrez Les Républicains estime ce nombre à un millier [3],

France wishes to use this time to progress towards an international solution under the OECD based on the two pillars of minimum tax global minimum tax on companies and digital tax on digital companies, France is continuing in its aim to achieve fair taxation of digital companies, It wishes to find an international agreement under the OECD, which is still the best solution, We will not compromise on these principles,

Checking your tax notices and the status of your payments, To access your personal tax data for the past several years, log into your personal account and click on the link “Consulter” Consult, You can access the following data : Income tax returns and the corresponding tax notices,

Taxation in France Income Tax on personal income is progressive, with higher rates being applied to higher income levels four tax brackets, Low income earners salary less than 10,084 EUR do not pay income tax, but after this amount the tax grows until 45% for individuals who earn more than 158,222 EUR, The amount of tax that you pay is not based on your earnings as an individual, but on your earnings as a household, France …

Liste des impôts et taxes français — Wikipédia

Services

Taxe malus sur les véhicules les plus polluants

Return to Practices Return to Tax Title Fiscalité : France Description Une équipe fiscale de dix avocats à Paris aide les clients à naviguer dans le système fiscal français complexe, fournissant aux entreprises et aux particuliers des solutions pratiques,

· Non-residents usually pay tax on their France-sourced income at a minimum French tax rate of 20% for French-sourced income up to €27,519 and 30% for income above this threshold, How to file your income tax return in France, Thanks to the PAYE system, for every monthly salary you receive, you’ll pay your income tax there and then, in real-time,

Temps de Lecture Estimé: 8 mins

· Spouses: Married couples and those in civil partnerships are now exempt from paying inheritance tax in France, Parents, children, and grandchildren, Tax-free allowance: €100,000; 5% tax up to €8,072; 10% on €8,072–€12,109; 15% on €12,109–€15,932; 20% on €15,932–€552,324; 30% on €552,324–€902,838; 40% on €902,838–€1,805,677

Taxe d’habitation

French inheritance law and estate taxes

Si vous gagnez un salaire brut de 36 000 € par an en France, vous serez imposé de 7 157 €, Cela signifie que votre salaire net sera de 28 843 € par an, ou 2 404 € par mois, Votre taux d’imposition moyen est 19,9% et votre taux d’imposition marginal est 36,5% ,

Taxes in France in 2021: All You Need To Know

Tax: France

Digital tax

Calcul du salaire brut / net 2021

· Vérifié le 22 juin 2021 – Direction de l’information légale et administrative Premier ministre La taxe d’habitation est un impôt local qui dépend de votre logement, de sa localisation et de

· Vous devez payer le malus lors de la 1^re l’immatriculation en France de certains véhicules particulièrement polluants, Le malus est calculé selon les émissions de CO2 si le véhicule a fait l

tax france

France FR

· For French non-residents, taxes will usually be taken on France-sourced incomes at a 30% tax rate, For property tax on the earnings from the sale of properties in France, rates are set to 19% for all EU citizens and 33,33% otherwise, How to file a tax return in France

Income Tax France: French Income Tax Rates

5 lignes · In practice less than 50% of inhabitants in France pay any income tax at all; only around 14%