vi hotel tax

Airbnb to pay hotel tax in VI

Guests pay a hotel room tax of 12,5% of their gross room rate which is the total sum charged to a guest for the use of one or more rooms plus any additional charges such as energy surcharge or maintenance fee, but excluding charges for food, beverages, and gratuities, The hotel …

· The USVI’s hotel room tax is 125 percent of the gross room rental meaning it includes the gross room rate plus any additional charges such as energy surcharges and maintenance fees

Temps de Lecture Estimé: 2 mins

The Virgin Islands imposes a Gross Receipts Tax on total receipts from the conduct of business within the V I without reduction of any expenses whatsoever The Gross Receipts tax rate is 5%

· SURPRISE ! A la fin de votre séjour l’hôtel vous demande de régler une « Sales State Tax » Plaît-il ?? Oui vous avez bien entendu ! Une TVA de 14,75% ainsi qu’une taxe de séjour viennent s’ajouter à vos frais Le portail de réservation en ligne Booking,com malgré ses prix attrayants n’inclut pas la taxe hôtelière ! La taxe hôtelière qu’il faut rajouter sur place en

Hotel and Villa VI tax increase to 12,5%

Virgin-Islands-On-Line • View topic

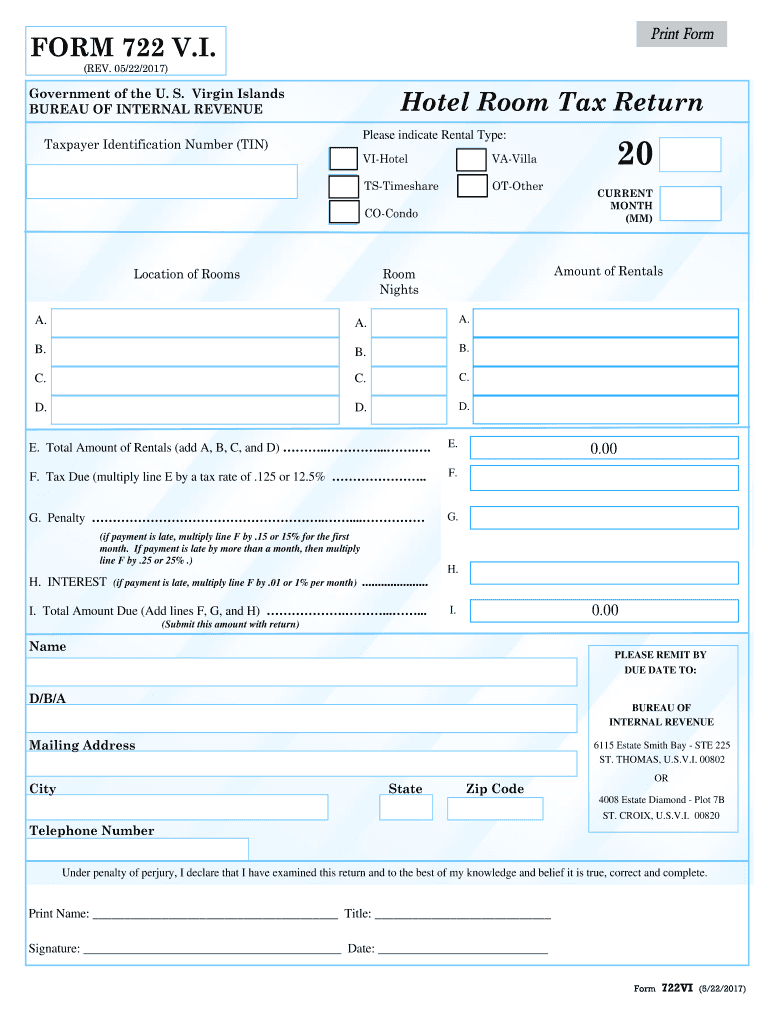

STX: 340 773-1040 Red Hook Crown Bay Estate Diamond See More Locations, feedback@irb,gov,vi, DO NOT USE THIS TO SEND TAX RETURNS, 6115 Estate Smith Bay Ste 225 St Thomas, VI 00802, 4008 Estate Diamond Plot 7-B Christiansted, VI 00820-4421,

Taxe de séjour : quelles sont les obligations des

vi hotel tax

Airbnb to pay hotel tax in BVI

· Airbnb to pay hotel tax in VI, This property in Cane Garden Bay is among the Virgin Islands’ 300-plus listings on Airbnb, Photo: CLAIRE SHEFCHIK Government has signed an agreement with Airbnb allowing the online booking agent to submit hotel accommodation tax directly to the government, according to a press release issued last Thursday,

Temps de Lecture Estimé: 5 mins

The US Virgin Islands Is Raising Its Hotel Tax

FORM 722 VI Government of the U S Virgin Islands

· Fichier PDF

I read this somewhere,The increase is 2,5% more for all staying after January 1, 2016, I guess we will be getting billed because it doesn’t matter when a person booked it appears,

VI Bureau of Internal Revenue

Ten percent 10% against the tax base, The tax base is calculated on the room rate,

· Airbnb to pay hotel tax in BVI, Government has signed an agreement with Airbnb allowing the online booking agent to submit hotel accommodation tax directly to the government, according to a press release issued last Thursday, On Nov, 20 Premier Andrew Fahie met with Airbnb International Senior Tax Manager Alan Maher to sign the agreement, “Your government views Airbnb as a valuable part of

I have heard that the USVI hotel tax is going to increase from 12,5% to 14%, Can anyone confirm this plan and when it is set to increase? Thanks,

gare à la tâxe hôtelière avec bookingcom

· Virgin Islands On Line, St, Croix ; St, John; St, Thomas; Villa Rentals, St, Croix Villa Rentals; St, Croix Villa Reviews; St, John Villa Rentals; St, John Villa Reviews

Increase to Hotel Tax?

Hotel Accommodation Tax Return after the date that it is due and the tax base is $7,500,00, the total amount due including the penalty would be calculated as follows: Tax Due $7,500,00 X 7% = $525,00 Penalty $525,00 X 20% =The Hotel Accommodation Taxation Ordinance, 105,00

Guide to Hotel Accomodation Tax

· Fichier PDF

Hotel Accommodation Tax

· Les hébergements non classés ou sans classement à l’exception des hébergements de plein air sont taxés entre 1 % et 5 % Le taux adopté s’applique par personne et par nuitée, Le montant afférent à la taxe de séjour est plafonné au plus bas des 2 tarifs suivants : le tarif le plus élevé adopté par la collectivité,

FORM 720 VI,

· Fichier PDF